By Vincent Kwofie

Mounting scrutiny is surrounding a high-value gold trade dispute involving Sesi-Edem Company Limited and JG Resources Limited, with accumulated financial exposure now estimated at over US$20 million.

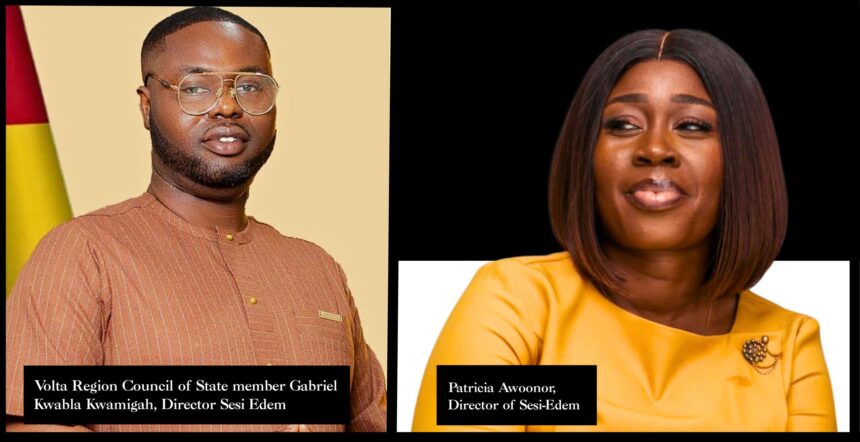

At the centre of the controversy are directors of Sesi-Edem Company Limited, including Gabriel Adovoe Kwabla Kwamigah, popularly known as Tanko Kwamigah, a serving Council of State representative for the Volta Region, alongside Patricia Awoonor. The dispute has also drawn attention to Sesi-Edem’s commercial dealings amid unresolved assay discrepancies, export documentation gaps, and settlement reconciliation issues.

The Transaction in Question

Records indicate that between June and July 2025, JG Resources Limited paid approximately GH¢57.7 million to Sesi-Edem Company Limited for the supply of 50 kilograms of gold, disbursed in three tranches under commercial invoices linked to export transactions.

However, the dispute centres on contract performance—specifically, differences between supplier assay figures and accredited refinery results at destination.

According to documentation referenced in the dispute:

-The official Dubai refinery assay, which governs final settlement under international bullion trade standards, confirmed delivery of approximately 29.2 kilograms of gold.

-This leaves an estimated 19.2-kilogram shortfall, equivalent to roughly US$17 million, outstanding as of July 2025.

Sesi-Edem’s internal assay records reportedly claim a delivery of about 30.8 kilograms, internally valued at roughly GH¢35.54 million. Even on those figures alone, industry sources say the unresolved financial exposure would still stand at approximately GH¢22.16 million.

Crucially, under the governing Sale and Purchase Agreement, accredited refinery assays—not supplier-generated documentation—determine final settlement value.

Assay Discrepancies and Industry Practice

Analysts note that in international gold trading, assay alignment is fundamental, determining valuation, contractual compliance, and settlement exposure. Differences between origin assays and refinery results frequently trigger disputes, especially when purity and fine-gold calculations materially affect payments.

Calls for independent verification, including a reconciliation through GoldBod channels, are reported not to have produced supporting documentation so far. Experts say delays in producing corroborating assay certificates often heighten regulatory scrutiny—particularly where export documentation, declared purity, and settlement figures diverge.

Governance and Public Interest Concerns

The matter has taken on an added governance dimension due to the involvement of a serving Council of State member. While public office does not imply wrongdoing, governance specialists note that politically exposed persons involved in high-value export transactions typically face elevated transparency expectations.

Where documentation gaps coincide with large financial exposure, scrutiny tends to intensify rapidly.

Competing Claims and Legal Tensions

Some narratives have attempted to reframe the dispute around alleged documentation irregularities involving JG Resources Limited. The company has categorically rejected allegations of forgery, describing them as reckless and unsupported by any regulatory or judicial finding.

JG Resources maintains that its recovery position rests on:

-Contractual performance reconciliation

-Accredited refinery assay outcomes

-Outstanding supply and settlement obligations

Sources familiar with the transaction say informal talks once explored possible contract abrogation after global gold price movements complicated continued supply. Refund negotiations reportedly failed, and a structured dispute resolution process did not yield settlement, amid growing regulatory interest.

Parallel Legal and Regulatory Actions

Separately, JG Resources Limited and its directors are facing legal and regulatory scrutiny linked to a US$17 million gold transaction with Tayvest-FZCO. The issues include:

-Contempt proceedings before the High Court, where the company and its directors—Papa Yaw Owusu-Ankomah, Maame Akosua Asama Kuranchie, and Kwaku Appiah Yeboah—are accused of defying a December 2025 court order to freeze accounts and deposit funds into court.

-Allegations of forgery and unauthorized name usage, made by Sesi-Edem Company Limited, which JG Resources disputes.

-Ongoing investigations by the Criminal Investigation Department and the Economic and Organised Crime Office (EOCO) into claims that gold quantities delivered did not match amounts paid.

The contempt case is expected to continue in March 2026.

Broader Implications

Industry observers caution that unresolved disputes of this scale risk undermining Ghana’s gold trade credibility, a sector critical to foreign exchange inflows, fiscal stability, and investor confidence.

For now, the controversy remains anchored in assay discrepancies, unresolved delivery obligations, and outstanding financial reconciliation. Analysts stress that its resolution will depend less on public narratives and more on documentary verification, accredited assay certification, regulatory findings, and—if necessary—formal adjudication.