A distinguished panel of SME leaders, trade experts and policymakers has called for urgent, coordinated action to improve access to finance, expand markets and strengthen cross-border value chains for small and medium-sized enterprises (SMEs) across Africa.

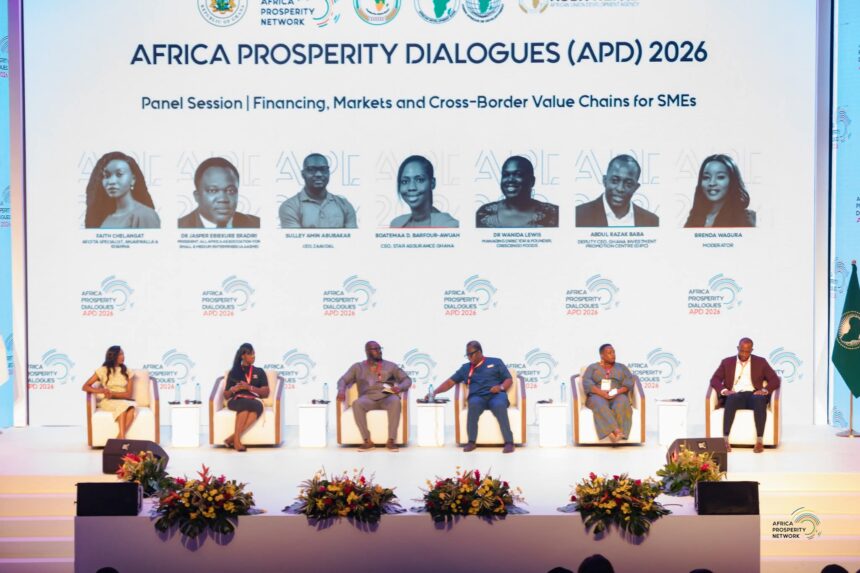

The panelists made the call during a panel session held under the theme “Financing, Markets and Cross-Border Value Chains for SMEs” at the 2026 Africa Prosperity Dialogues, on Thursday, 5 February 2026.

The panel session focused on empowering small and medium-sized enterprises (SMEs) to turn ambition into action within Africa’s single market by exploring practical strategies for sustainable growth. Discussions highlighted innovative financing solutions, effective public–private partnerships, and the use of digital platforms and trade agreements to unlock new markets and build resilient supply chains.

The session aimed to equip SMEs with practical insights into available financial models, emerging opportunities in cross-border value chains, and the tools needed to navigate and access Africa’s integrated market of over 1.5 billion consumers, in pursuit of shared prosperity across the continent.

The panel featured a distinguished group of SME leaders, trade experts, and policymakers, including Faith Chelangat, AfCFTA Specialist at Anjarwalla & Khanna Advocates; Dr Jasper Ebiekure Eradiri, Chief Executive Officer of the Association of African SMEs; Sulley Amin Abubakar, Chief Executive Officer of Zaacoal; Boatemaa D. Barfour-Awuah, Chief Executive Officer of Star Assurance Ghana; Dr Wanida Lewis, Managing Director and Founder of Crescendo Foods; and Abdul Razak Baba, Deputy Chief Executive Officer of the Ghana Investment Promotion Centre (GIPC). The session was moderated by Brenda Wagura, an international trade and investment legal expert.

Panelists agreed that SMEs, which account for about 90 per cent of businesses in Africa and provide the majority of jobs, remain constrained by limited access to affordable financing, fragmented markets and weak integration into regional and continental value chains.

Food SMEs

Dr. Wanida Lewis, Managing Director and Founder of Crescendo Foods, underscored the importance of compliance, food safety, and market readiness in enabling African food entrepreneurs to scale and compete across borders. She said Crescendo Foods focuses on helping food SMEs build strong operational systems that align with regulatory requirements in Ghana, across the continent, and globally.

She explained that Crescendo Foods works closely with aligned partners, including Ghanaian-owned food safety testing firms, to help entrepreneurs understand and adopt compliance requirements early in their business journey. According to her, early engagement with food safety testing and regulatory standards removes fear and intimidation, allowing entrepreneurs to approach compliance as a practical and manageable process rather than a barrier to growth.

Dr. Lewis added that the company also collaborates with regulatory institutions such as the Ghana Food and Drugs Authority and the Ghana Standards Authority, organizing workshops and trainings to guide businesses through compliance checklists. She noted that by working with partners who understand both local and global standards, food businesses are better positioned to become market-ready, borderless, and aligned with the African Continental Free Trade Area (AfCFTA).

Strategic Advantages

Abdul Razak Baba, Deputy Chief Executive Officer of GIPC, highlighted Ghana’s strategic advantages as an investment destination for SMEs. He pointed to the country’s central location in West Africa, its modern transport infrastructure, and its resource base that supports value addition and industrial growth.

“We have the biggest and busiest airport in West Africa,” he said. “We also have the natural resources needed for value addition and one of the most generous incentive packages in the sub-region.”

He noted that Ghana’s corporate tax rate of 25 percent compares favorably with the African average of about 28 percent, making the country more competitive for investors.

“These are some of the measures we are putting in place to support small businesses like those represented here today,” Baba said, reaffirming GIPC’s commitment to creating an enabling environment for SME-led growth.

SMEs Must Rethink

Boatemaa D. Barfour-Awuah, Chief Executive Officer of Star Assurance Ghana, called on small and medium-sized enterprises (SMEs) to rethink the role of insurance as a critical tool for managing business risk, particularly in cross-border trade. Speaking during a panel discussion, she stressed that insurance should not be seen as optional but as an essential component of proper business structuring for SMEs seeking to grow and export.

She explained that for SMEs engaged in exporting, securing goods in transit is one of the most important risk management steps. Whether goods are transported by air, road, or sea, appropriate insurance policies such as goods-in-transit or marine cargo insurance—help protect businesses against losses arising from damage, theft, or missing shipments. According to her, insurance functions as a risk transfer mechanism that shields SMEs from potentially devastating financial setbacks.

Barfour-Awuah noted that many of these insurance solutions are affordable, with premiums as low as 0.25 per cent of the value of the shipment. Given the tight margins within which most SMEs operate, she emphasized that having adequate insurance coverage can make the difference between business continuity and financial distress when unforeseen events occur.

Building Successful SMEs

Sulley Amin Abubakar, CEO of ZAACOAL, shared the journey of building a successful SME in the informal charcoal industry, highlighting the challenges of accessing finance for innovative but unconventional businesses. He explained that while billions of Africans rely on charcoal daily, financiers initially struggled to see the potential in ZAACOAL’s business model, emphasizing that funding often flows not just to good ideas, but to ventures that demonstrate structured operations and growth potential.

Abubakar detailed how ZAACOAL navigated early financial hurdles by strategically tapping government grants, pitching competitions, and incremental funding to develop a minimum viable product (MVP) and prove market demand. He emphasized that building systems, structuring the venture, and assembling a strong team were critical to gaining investor confidence, illustrating the often-overlooked importance of organizational readiness for SMEs seeking investment.

Critical Role of SMEs

Dr. Jasper Ebiekure Eradiri, President of the All Africa Association for Small-Scale and Medium Enterprises (AAASME), emphasized the critical role of SMEs as the engine of Africa’s economic growth. He highlighted the importance of coordinated engagement, noting that SMEs working individually often struggle to achieve significant impact. “When SMEs go as a group, as a bloc, they can engage with institutions like the African Union or UN systems to drive meaningful change,” he explained, underscoring the value of public-private dialogues and pan-African cooperation for advancing the interests of small and medium enterprises across the continent.

Dr. Eradiri pointed to the establishment of the AU SME Forum as a key milestone in creating a structured platform for SMEs to influence continental policy. Approved by heads of government in 2022, the forum allows SMEs to provide feedback on AU initiatives while discussing issues like market access, financing, and cross-border trade challenges. He mentioned that persistent barriers, including non-tariff barriers (NTBs) and technical barriers to trade (TBTs), which complicate the ability of SMEs to operate across African markets, emphasizing the need for integrated and inclusive solutions.

Clearing Misconceptions

Faith Chelangat, AfCFTA Specialist at Anjarwalla & Khanna, also highlighted the critical role of women, youth, and SMEs in Africa’s trade landscape. She emphasized a common misconception among entrepreneurs: that a product’s country label automatically determines its origin. “The rules of origin are not geographical; they are mathematical,” Chelangat explained, pointing out that proper certification and understanding of value addition are essential for businesses to benefit from preferential trade agreements under the AfCFTA.

Chelangat stressed that SMEs often face hidden costs when exporting without the necessary certificate of origin. Without it, businesses are forced to pay the standard Most Favored Nation (MFN) tariffs, even when trading under AfCFTA agreements designed to reduce duties. She cautioned that failure to comply could lead to post-clearance audits by revenue authorities, potentially resulting in additional penalties.

Credit: Philip Abutiate