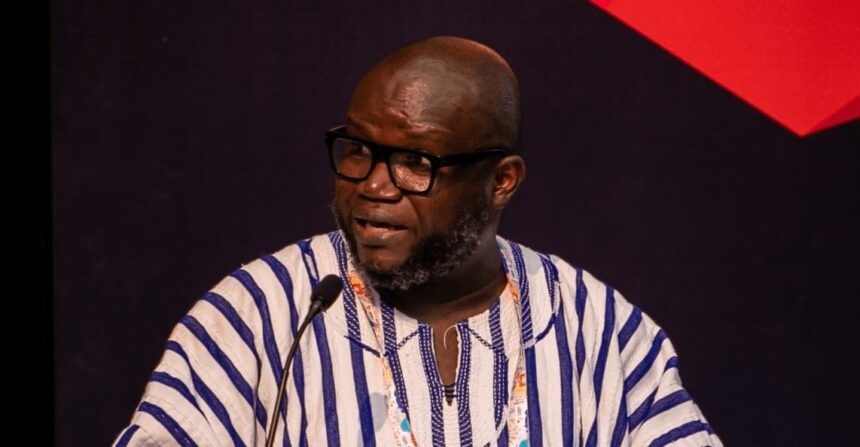

The Chief Executive Officer of the Ghana Chamber of Mines, Dr Ken Ashigbey has raised concerns about the limited fiscal returns from the smakk-scale mining sector.

According to him while large-scale mining companies generated about GH¢17.7 billion in government revenue in 2024, players within the small-scale sector produced an estimated 34% of gold that year contributed far less in fiscal terms.

In 2025, Dr Ashigbey said small-scale miners contributed less than 2% to government revenues, despite producing over half of national output.

Speaking to the media, Dr Ashigbey said the growing dominance of the small-scale mining sector has significantly altered the ownership structure of Ghana’s gold industry.

He added that small-scale miners now account for over half of national gold production, with Bank of Ghana data indicating that they produced about 51% of total output in 2025.

His conversation comes on the back of a debate that foreigners carting away Ghana’s gold, insisting that the bulk of gold produced, owned and traded in the country is now firmly in Ghanaian hands.

“When you add the 50% from small-scale mining and the additional 20% that comes through other domestic channels, about 70% of our gold is in our hands. So the conversation that foreigners are coming to take our gold is really not factual,” he stated.

He further argued that the proposed amendments to the royalty regime, including a sliding scale of between 5% and 12%, could disproportionately burden small-scale miners if applied uniformly.

“If a small-scale miner is required to pay royalties of up to 12% at today’s prices, it could hurt the system, while stressing the need for fairness and non-discrimination in the application of mining laws,” he said